Nashville, the vibrant capital of Tennessee, is known for its rich history, thriving music scene, and booming economy. As the city continues to grow and attract new residents, the importance of financial planning for Nashville locals cannot be overstated.

In this article, we will delve into the significance of financial planning for individuals and families in Nashville, highlighting the unique financial challenges faced by residents in the area and the benefits of working with a local financial planning firm like Retirement Renegade.

Understanding Nashville’s Unique Financial Landscape

- Fluctuations in the cost of living: The cost of living in Nashville has been steadily increasing over the years, which can impact your financial planning strategies. It’s essential to work with a financial planning firm in Nashville that understands these fluctuations and can help you adjust your financial plans accordingly.

- Variable income streams: Nashville is home to a diverse workforce with various income streams. Some residents have steady salaries, while others have irregular income from freelance or entrepreneurial pursuits. A financial planning firm in Nashville should be well-equipped to help clients manage variable income streams and create strategies tailored to their unique financial situations.

- Increased housing prices: Nashville’s booming real estate market has led to a surge in housing prices. This increase can have a significant impact on your financial plans, whether you’re a homeowner or looking to invest in property. A financial planning firm in Nashville should be able to help you navigate this complex market and make informed decisions about real estate investments.

Planning for taxes and regulations: As a resident of Nashville, you’ll need to be aware of local and state tax regulations that can affect your financial planning. It’s essential to work with a financial planning firm that is well-versed in these regulations and can help you optimize your tax strategies and ensure compliance.

- Diversification and risk management: Nashville’s dynamic economic landscape calls for a diversified investment approach to minimize risk and maximize returns. A financial planning firm in Nashville should have the expertise to help you create a diversified portfolio tailored to your specific needs and risk tolerance.

The Retirement Renegade Difference

Benefits of Working with a Local Financial Planning Firm

Partnering with a local financial planning firm like Retirement Renegade offers several advantages to clients seeking to build and protect their wealth in Nashville. These benefits include:

- Knowledge of the Nashville market and its unique financial landscape: A local financial planning firm has a deep understanding of Nashville’s dynamic economic environment and the challenges it presents. This knowledge enables them to provide tailored financial advice and strategies that take into account the specific conditions of the Nashville market.

- Tailored financial planning services to meet clients’ individual circumstances: Every client’s financial situation and goals are unique. A local financial planning firm like Retirement Renegade can offer personalized financial planning services designed to address each client’s specific needs and objectives.

Access to a team committed to providing comprehensive financial planning services: Retirement Renegade has a dedicated team of professionals who are committed to offering a complete suite of financial planning services. This includes retirement planning, tax planning, insurance, and estate planning, ensuring that every aspect of their clients’ financial lives is well-coordinated and seamlessly integrated.

- Strong community connections: A local financial planning firm has strong ties to the Nashville community and can leverage these connections to help clients access a network of professionals, such as attorneys, accountants, and insurance specialists. This collaborative approach ensures that clients receive the best possible advice and support.

- Commitment to Ongoing Education and Training: Retirement Renegade places a strong emphasis on staying current with the latest financial trends and regulations affecting the Nashville community. As a member of the National Association of Certified Financial Fiduciaries (NACFF), their commitment to ongoing education and professional development ensures that they consistently deliver the highest level of service to their clients.

Conclusion

How does the Nashville financial landscape affect my financial planning strategy?

The Nashville financial landscape, characterized by its diverse economy, can influence your financial planning strategy by presenting unique challenges and opportunities. Understanding these factors, such as fluctuations in the cost of living, variable income streams, and increased housing prices, is crucial in developing a tailored financial plan that addresses your specific needs and goals.

How can a financial planning firm in Nashville help me achieve my short-term and long-term financial goals?

A financial planning firm in Nashville can help you achieve your financial goals by creating a customized financial plan that takes into account your unique circumstances, risk tolerance, and objectives. They can provide expert advice on investments, retirement planning, tax planning, insurance, and estate planning, ensuring a holistic approach to managing your financial life.

What types of financial planning services are offered by Retirement Renegade?

Retirement Renegade offers a comprehensive suite of financial planning services, including investment management, retirement planning, tax planning, insurance, and estate planning. Their personalized approach ensures that every aspect of your financial life is well-coordinated and tailored to your specific needs and objectives.

How can I ensure that I am choosing the right financial planning firm in Nashville for my needs?

To choose the right financial planning firm in Nashville, consider factors such as the firm's expertise, reputation, commitment to ongoing education and training, and the range of services they offer. Schedule a consultation to discuss your financial goals and assess whether the firm's approach aligns with your needs and preferences.

How does Retirement Renegade stay updated on the latest financial trends and regulations?

Retirement Renegade is a member of the Financial Planning Association Nashville, which ensures they stay up-to-date with the latest financial trends and regulations affecting the local community. Their commitment to ongoing education and training enables them to provide the highest level of service to their clients.

What role does ongoing education and training play in the success of a financial planning firm in Nashville?

Ongoing education and training play a crucial role in the success of a financial planning firm in Nashville, as it ensures that their team stays current with the latest financial trends, regulatory changes, and investment strategies. This enables them to provide informed and effective advice to their clients.

How can a financial planning firm in Nashville help me manage the fluctuations in the cost of living and housing prices?

A financial planning firm in Nashville can help you manage fluctuations in the cost of living and housing prices by developing a tailored financial plan that accounts for these factors. They can provide advice on budgeting, saving, investing, and insurance strategies to help you navigate the local financial landscape and achieve your financial goals.

What are the key elements to look for when choosing a financial planning firm in Nashville, TN?

When choosing a financial planning firm in Nashville, TN, look for key elements such as expertise in the local market, a commitment to personalized client service, a comprehensive range of financial planning services, adherence to fiduciary standards, ongoing education and training, and a collaborative approach to financial planning. These elements indicate a firm that is well-equipped to help you achieve your financial goals.

Planning for taxes and regulations: As a resident of Nashville, you’ll need to be aware of local and state tax regulations that can affect your financial planning. It’s essential to work with a financial planning firm that is well-versed in these regulations and can help you optimize your tax strategies and ensure compliance.

Planning for taxes and regulations: As a resident of Nashville, you’ll need to be aware of local and state tax regulations that can affect your financial planning. It’s essential to work with a financial planning firm that is well-versed in these regulations and can help you optimize your tax strategies and ensure compliance.

In the ever-evolving financial landscape, wealth management firms play a crucial role in guiding clients toward their long-term financial goals. Nashville, a burgeoning hub for finance, is home to many reputable wealth management firms that offer comprehensive services to help clients build, protect, and grow their wealth. In this article, we will discuss the best practices of wealth management firms in Nashville and explore why partnering with one of these firms can be the key to achieving financial success.

In the ever-evolving financial landscape, wealth management firms play a crucial role in guiding clients toward their long-term financial goals. Nashville, a burgeoning hub for finance, is home to many reputable wealth management firms that offer comprehensive services to help clients build, protect, and grow their wealth. In this article, we will discuss the best practices of wealth management firms in Nashville and explore why partnering with one of these firms can be the key to achieving financial success. In a competitive market like Nashville, finding the right wealth management firm to help you build, protect, and grow your wealth can be challenging. Retirement Renegade stands out from the competition, offering personalized service,

In a competitive market like Nashville, finding the right wealth management firm to help you build, protect, and grow your wealth can be challenging. Retirement Renegade stands out from the competition, offering personalized service,  In conclusion, choosing Retirement Renegade as your wealth management partner in Nashville offers a range of unique advantages that can significantly enhance your financial well-being. Our commitment to personalized service, comprehensive financial planning, and the latest technology ensures that our clients receive the highest level of guidance and support. To learn more about our services and how we can help you on your financial journey, visit our website or contact us today.

In conclusion, choosing Retirement Renegade as your wealth management partner in Nashville offers a range of unique advantages that can significantly enhance your financial well-being. Our commitment to personalized service, comprehensive financial planning, and the latest technology ensures that our clients receive the highest level of guidance and support. To learn more about our services and how we can help you on your financial journey, visit our website or contact us today.

In a city like Nashville, with its thriving economy and diverse population, it’s essential to find the right financial planner to help guide you on your path to financial success. The best financial planner in Nashville will possess the necessary credentials, such as being a

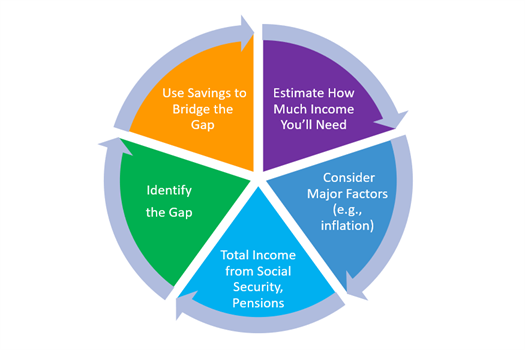

In a city like Nashville, with its thriving economy and diverse population, it’s essential to find the right financial planner to help guide you on your path to financial success. The best financial planner in Nashville will possess the necessary credentials, such as being a  Working with a comprehensive financial planner in Nashville means that you’ll receive a complete evaluation of your financial situation. This includes analyzing your income, expenses, investments, insurance coverage, and retirement savings to create a holistic financial plan. A comprehensive financial planner will ensure that all aspects of your financial life are considered and aligned with your goals and values.

Working with a comprehensive financial planner in Nashville means that you’ll receive a complete evaluation of your financial situation. This includes analyzing your income, expenses, investments, insurance coverage, and retirement savings to create a holistic financial plan. A comprehensive financial planner will ensure that all aspects of your financial life are considered and aligned with your goals and values. A financial planner in Nashville, such as those at

A financial planner in Nashville, such as those at  A financial planner can be an invaluable source of financial education. They can help you understand complex financial concepts, investment strategies, and tax laws that impact your financial plan. By working with a financial planner in Nashville, you can gain the knowledge and confidence to make informed decisions about your financial future.

A financial planner can be an invaluable source of financial education. They can help you understand complex financial concepts, investment strategies, and tax laws that impact your financial plan. By working with a financial planner in Nashville, you can gain the knowledge and confidence to make informed decisions about your financial future. As you can see, working with a financial planner in Nashville offers an array of benefits that can help you navigate the complexities of personal finance and achieve your financial goals. Whether you’re just starting your financial journey or looking to refine your existing financial plan, a certified financial planner in Nashville can provide the expertise and guidance you need.

As you can see, working with a financial planner in Nashville offers an array of benefits that can help you navigate the complexities of personal finance and achieve your financial goals. Whether you’re just starting your financial journey or looking to refine your existing financial plan, a certified financial planner in Nashville can provide the expertise and guidance you need.